Table of Contents

Big data has definitely become a buzzword during the last few years. And there is not just hype: the amount of data is growing exponentially month after month thanks to the spread of available mobile devices, cameras, microphones, Internet of Things devices, etc.

It might seem that big data could be an item for leading startups or tech giants. It is not true: every business that handles great amounts of data on a daily basis might leverage it to gain additional value, and enhance processes and decision-making, which, in turn, will lead to higher profits.

Insurance is one of the industries that can prosper from big data. In this article, we will explain how can your insurance company implement big data and what output it can get.

The Role of Big Data for Insurance

The whole concept of the insurance business is built on risk assessment. Whether you provide property and casualty insurance or any other type of insurance policy, the main task is to assume possible risks relevant for every single client and predict the possibility that this policyholder will make a claim.

Obviously, obtaining and analyzing data is a cornerstone for this process. Basically, the more efficiently you are able to assess risks, the more precisely you will be able to detect high-risk policyholders and set appropriate insurance premiums that will keep your insurance company profits on a high level.

So what about big data? It gives insurance providers more detailed and diverse customer data that can be used to distinguish more narrow demographic groups (e.g., not just “male under 25”, but “unmarried man under 25 who owns a car with passive restraints and who commutes to work”). Thanks to new digital data sources like social media or IoT devices, companies get a deeper insight into the customers’ qualities and behavior that will statistically increase or decrease risks and determine the premium amount that should be paid by every other customer.

So, as you can see, big data can significantly reinvent your approach to the insurance processes. However, the opportunities can be much wider and change not only risk assessment, but some other operations that happen in the insurance business, and we will talk about them further.

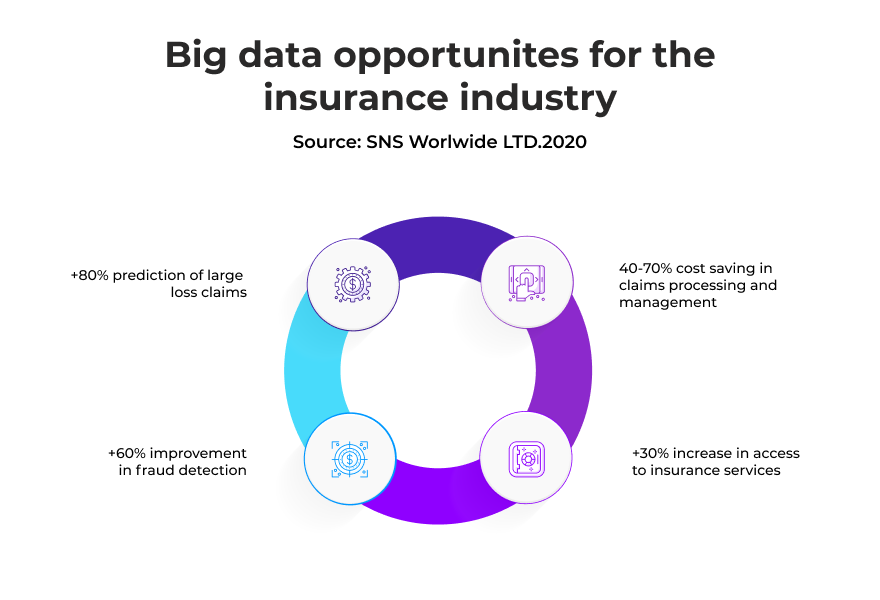

The Benefits of Using Big Data for Insurance Companies

So, what difference can big data make for most insurance companies? Here are a few advantages you can get.

- Prevention of claims fraud: by checking the tendencies of previous fraudulent cases and analyzing external trends, you will be able to identify fraud more efficiently than in the past.

- Enhanced claims settling : this process requires the manual efforts of an adjuster, but nowadays, big data can help to detect dependent and independent variables that will help to settle claims much faster and easier.

- Better customer acquisition: through social media, insurance companies can get data about consumer behavior and later use it to create targeted promotional ads;

- Better custom retention: by collecting insights on customers’ behavior and detecting early signs of dissatisfaction with your company and resolving issues that are disturbing the client.

- Cost optimization: big data combined with other advanced technologies allow you to automate certain processes and leverage the efforts of your employees more wisely, which leads to reduced expenses.

- Enhanced processes: automation and reliance on technologies will allow you to speed up the internal processes and relieve your employees from manual, repetitive tasks.

- Enabled business growth: through more precise risk calculation due to better data management and analytics, insurance companies can reduce revenue leaks and access new business opportunities.

- Competitive edge: again, enhanced risk calculation helps to avoid excessive risk exposure which, in turn, allows insurers to reduce premium costs and provide more personalized service.

The Types of Big Data Used In the Insurance Industry

There are several types of big data that companies might use for different types of insurance coverage.

Geo Data

The data that shows the location where the policyholder lives and works have significant importance for insurance companies. It will reveal whether the client has an increased risk to suffer from certain types of cataclysms (floods, earthquakes), whether they might become a victim of crime due to living in zones with higher crime rates, if there is a risk of toxic wastes affecting the client’s health, etc. Useful for:

- life insurance;

- casualty insurance;

- health insurance;

- property insurance;

- car insurance.

IoT Data

The Internet of Things (IoT) reveals additional capacities for an insurer to track and analyze the behavior patterns, health conditions, and property state of a certain client. So, instead of relying only on general, statistical data, companies can understand risks for the specific person and offer personalized offers for them. In turn, this helps companies to protect themselves from revenue leaks by providing more reasonable underwriting, and clients have a better chance to get payment in case of an insured loss. Useful for:

- car insurance;

- health insurance;

- property insurance.

Hazard Data

This type of data is collected during and after the hazardous event (earthquake, flood, hurricane, etc.) to understand the level of its severity. Usually, it is used to predict the possible risks for a certain client and set optimal pricing for the insurance policy. Useful for:

- property insurance;

- casualty insurance.

Behavioral Data

By acquiring the relevant types of data, companies can detect the behavior patterns of their prospects: how they make buying decisions, what factors they consider when choosing an insurance provider, etc. As we have mentioned, this information will help to enhance customer acquisition by helping to understand how to approach certain groups of prospects. Useful for:

- any type of insurance company.

Online Media Data

Nowadays, you can get to know a person solely from their social media accounts. It might be a great source of information for insurers that might help to understand the lifestyle and behavior of their clients, and hence, calculate risks more precisely. However, you should be extra careful, as you can’t break any regulation related to personal data protection (e.g, GDPR) and leverage data you don’t have permission to use.

- any type of insurance company.

Implementing Big Data for Your Insurance Company

So, you have weighed the pros and cons of leveraging big data for your company and decided to implement it. Congrats!

The next question you might ask is: what actions should be taken to do that? What should we start with? Truth be told, the most simple way for any insurance company would be to hire a vendor like Altamira that specializes in data solutions and would have a holistic approach to satisfy your request.

We know how to capitalize on the value of your big data and use it to improve your customer services, access new revenue streams, and optimize operational expenses.

Here is what the general process of implementation looks like:

- a detailed study to understand what are the needs and requirements of your insurance company;

- conceptualization of the data solution for your business, architecture, and backlog preparation;

- the development and testing of your data solution using the Scrum framework;

- deployment of your big data solution.

However, we approach every project individually and always consider your particular case to deliver the solution which will fulfill your needs.

Why Choose Altamira as Your Data Solution Vendor?

Altamira offers a wide data solution landscape that can help your company to build an appropriate and efficient data model for insurance. Our service card includes:

- data management and strategy;

- data migrations;

- artificial intelligence and machine learning;

- data access.

By cooperating with us, you benefit from:

- a team of strong data experts with more than 8 years in big data, cloud computing and more than 24 years in data warehousing and business intelligence with a solution architect certification by AWS;

- more than 11 years of delivering various data solutions to different types of businesses;

- a wide portfolio of delivered data solutions;

- the proven framework that allows us to mitigate possible development risks and ensure fast and stable delivery;

- high level of performance proved with a 70% NPS and average client lifetime of 4 years;

- transparent and straightforward reporting and communication with clients.

In Conclusion

Big data is a great opportunity no insurance company should miss. It is a key to business growth and reduced chances of profit losses, better, personalized services, optimized expenses, and enhanced efficiency.

Apply to Altamira if you plan to finally capitalize on the vast amounts of data you already have or can possibly acquire, and we would help you to upgrade your business.

FAQ