Stress testing involves creating an environment where pressure is applied to an object or system to test its resistance to various economic conditions. This approach is used quite often in several industries, from construction to cardiology. For example, doctors efficiently execute cardiac tests by getting patients to run on treadmills while monitoring their heart rate and blood pressure. In banks, stress testing involves analyzing how these institutions will cope with hypothetical adverse scenarios such as significant downturns or financial crises.

The disastrous financial crisis of 2007-2009, often referred to as the Great Recession, prompted banking regulators worldwide to improve their risk management tools and make financial firms more resilient to future downturns.

Definition of bank stress testing

According to the Basel II concept of capital, stress testing tool is a must-have for assessing a financial company’s capital adequacy in adverse market conditions. Stress testing helps banks prepare for adverse situations and gives an idea of how much capital is needed to cover losses during an economic downturn. This tool complements other approaches to risk management, thereby:

- Providing forward-looking risk assessments

- Overcoming the limitations of models and historical data

- Support for internal and external communication

- Introduction to capital and liquidity planning procedures

- Informing about adjusting the bank’s risk tolerance

- Facilitate the development of risk reduction or emergency plans for a range of stressful conditions

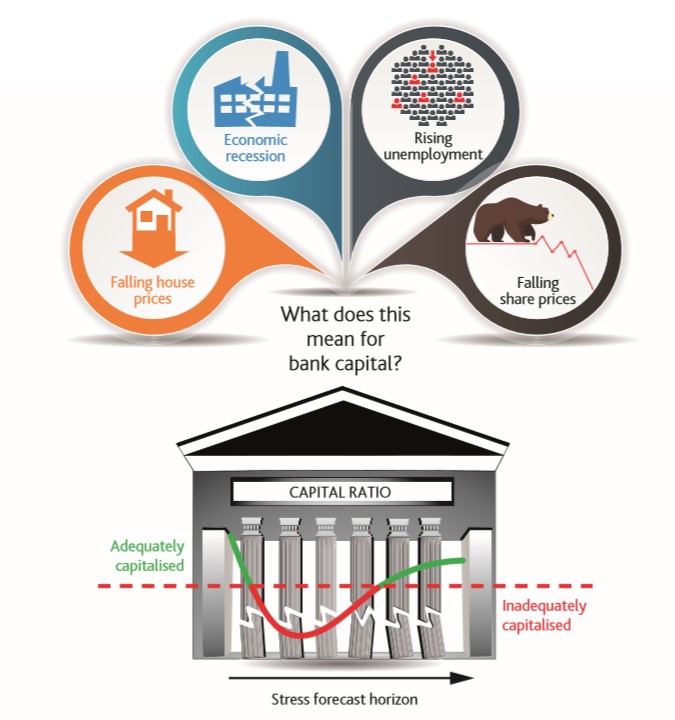

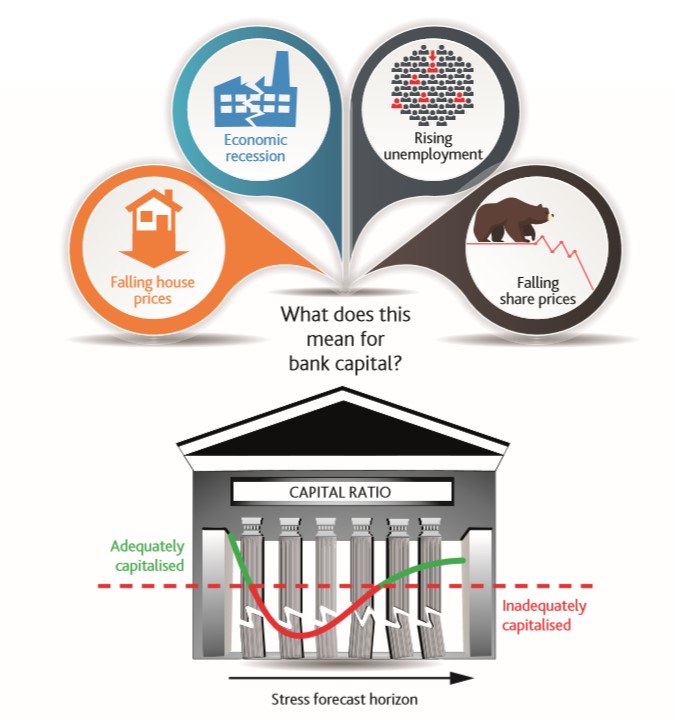

Bank stress tests usually begin by drawing up a specification of hypothetical stress scenarios. They typically include economic and financial market variables that are generally more important than the stress testing authority’s core expectations. Various methods are then used to simulate the impact of a hypothetical adverse macroeconomic situation to assess its impact on profitability and bank balance sheets.

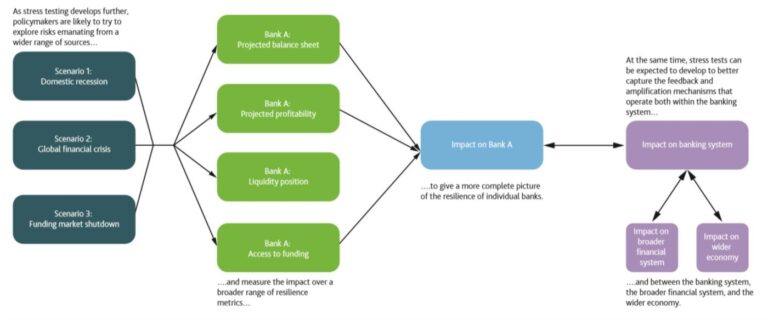

Bank stress testing is still a relatively new area, and we anticipate that it will evolve to improve the resilience of banking and the system as a whole.

Unfavorable scenarios usually contain hypothetical factors for a set of economic and financial market variables that could lead to losses. Scenarios could include the following developments, such as a severe recession with a fall in GDP, a sharp drop in house prices, and rising unemployment. Scenario impact analysis involves modeling how the scenario might affect various aspects of the participating banks’ business. For example, rising unemployment reduces some households’ income and may mean that more will not pay off their mortgages and other loans.

A stress test is usually conducted under the direction of an official body, such as a regulatory bank, with the balance sheets of several banks being taken simultaneously, which may be suitable for a particular unfavorable scenario. Stress tests of this kind have become most widespread since the global financial crisis.

Despite these benefits, stress testing programs do not provide clear strategies for dealing with a crisis. The stringent scenarios used in company stress tests, designed to assess overall capital requirements and potential fluctuations at the enterprise level, usually did not match the observed results during periods of economic downturn.

In particular, the financial crisis has highlighted four significant weaknesses.

- Use of stress testing and integration into risk management

- Stress testing methodologies

- Scenario selection

- Stress testing of emerging risks and products

Regulators have responded to these observed weaknesses by issuing new rules and guidelines to improve the stress testing systems of the financial industry.

In the United States, banks use three different conditions to assess their sufficient capital level: baseline, unfavorable, and extremely unfavorable conditions. For example, banks may need to simulate an environment with high unemployment, a housing market crash, and a slowdown in economic growth. The Federal Reserve provides detailed stress testing data annually, telling banks which specific assumptions to use.

Why are banks tested?

Healthy banks are critical to the functioning of the economy and affect our daily lives. When large banks pose a “systemic risk,” they can cause widespread severe damage in the event of bankruptcy, so regulators set rules to prevent such consequences.

The simplest model of a bank is an institution that accepts deposits and lends that money to other customers. But the situation has gotten to the point where banks are taking on greater risk and using increasing amounts of leverage to increase profits.

During the 2007-2009 financial crisis, financial markets came to a standstill. Large financial institutions went bankrupt, and undercapitalized banks could not cover losses and survivein loan loss models. These setbacks set off a chain reaction of increasingly frightening events.

Ultimately, the US government (and other governments around the world) intervened to stabilize financial markets. The US government has backed several large financial institutions and mortgage agencies to keep the financial system liquid. As a result, global financial institutions have become more willing to do business, helping people, businesses, and governments get the money they need. What’s more, the FDIC and NCUA have increased deposit insurance amounts from $ 100,000 to $ 250,000 to boost consumer confidence and prevent massive withdrawals from banks.

Types of stress tests

Banks, bank holding companies, and other institutions with more than $ 250 billion in assets must perform stress tests. Which tests will take place will depend on the bank.

Dodd-Frank Stress Testing (DFAST)

All banks above the $ 250 billion thresholds must meet the DFAST requirements by periodically conducting corporate tests (annually or twice a year, depending on the type of institution) and submitting the results to the Fed3.

Dodd-Frank stress testing principles and methods

The idea of stress testing has been widely presented by the Basel Committee on Banking Supervision (BCBS) under the Basel II capital concept. Shortly after that, US regulators embraced the idea and incorporated stress testing exercises into banking industry requirements. Due to the shortcomings of the banking industry stress testing programs seen during the financial crisis, BOBS published principles for robust stress testing. US regulators jointly issued supervisory stress testing guidance for banking institutions with assets over $ 10 billion.

Besides, following the signing of the Dodd-Frank Wall Street Reform and Consumer Protection Act, two different stress testing exercises went into effect: Comprehensive Capital Analysis and Review (CCAR) and Dodd-Frank Stress Tests (DFAST). into federal law in July 2010.

Comprehensive analysis and capital review

The Comprehensive Capital Analysis and Review stress testing was added to US banking regulation in November 2011 with the capital plan rule’s adoption. This rule applies to bank holding companies with assets of $ 50 billion or more. The application must also include a description of internal policies and procedures related to capital adequacy assessments and various documentation related to the model. The Federal Reserve System processes this information to assess the financial condition, risk profile, and capital adequacy of banking institutions on a forward-looking basis.

The Federal Reserve’s quantification of overhaul plans is based on stress tests conducted for three surveillance scenarios (baseline, unfavorable, highly unfavorable) and two internal scenarios (baseline BHC, unfavorable BHC). The regulation requires federal supervisors to ensure that banks maintain an overall Tier 1 ratio of at least 5 percent throughout all forecast scenarios.

Comprehensive Capital Analysis and Review (CCAR)

Banks with more than $ 100 billion in assets are also required to undergo more rigorous supervisory stress testing by CCAR. For the largest organizations (assets over $ 250 billion), the CCAR can include qualitative and standard quantitative elements. Qualitative reviews include reviewing the bank’s internal policies and procedures for problem-solving, proposed corporate actions, etc.

To maintain an efficient capital adequacy process, regulators recommend that the bank adheres to seven fundamental principles:

- Reliable management of significant risks

- Effective loss assessment methodologies

- Robust resource estimation methodologies

- Sufficient assessment of the impact on capital adequacy

- Comprehensive capital policy and capital planning

- Reliable internal controls

- Good governance

A detailed description of each of the above principles can be found in the Federal Reserve’s 2015 Comprehensive Capital Analysis and Review Consolidated Guidelines and Recommendations.

RCRS Principles for Sound Stress Testing

The BCBS principles require stress testing to be an integral part of the overall risk management framework.

In 2009, 15 supervisory guidelines for banks were issued to address the deficiencies identified in the stress testing programs used during the financial crisis.

# 1 The first six principles relating to stress testing and its integration with risk management. These principles require stress testing to be an integral part of the overall risk management framework and emphasize the active involvement of the Board and senior management of the bank. One of the principles states that banks should have written policies and procedures governing the stress testing program and adequately document the stress testing review process. Banks need to have a sufficiently robust infrastructure to flexibly adapt to different and possibly changing stress tests at the appropriate levels of detail. Banks should also maintain and update their stress testing framework regularly, and the effectiveness of this system should be assessed regularly and independently.

# 2 The next four principles relate to stress testing methodology and scenario selection. Stress tests are required to consider a range of risks and be performed at the enterprise level. It is also essential for stress tests to cover a range of scenarios, including forward-looking scenarios, and take into account the impact of feedback.

In many cases, peer review can complement stress tests to address deficiencies in the process and improve risk identification.

Also, stress testing programs should include events that can cause the greatest possible damage. They should also identify which scenarios could jeopardize banks’ viability, thereby identifying hidden risks and the interrelationships between them. Finally, the stress testing program should consider the simultaneous pressures in equity and asset markets, and the impact of declining market liquidity on risk assessment.

# 3 The last five principles are guidelines for banks regarding specific risk mitigation and risk transfer areas that have been hit by the financial crisis. The effectiveness of risk reduction methods should be systematically questioned. Stress testing should cover complex and individual products, such as securitized risks. The bank should improve its stress testing methodologies to consider the impact of reputational risk and to integrate risks from off-balance sheet arrangements and other related entities. Approaches to stress testing highly leveraged counterparties should be strengthened by considering the bank’s vulnerability to specific asset categories or market movements and assessing the potential misleading risk associated with risk mitigation techniques.

Stress Test Requirements According to US Basel Standards

Pillar 2 stress testing concerns not only the fluctuations in the minimum regulatory capital requirements recorded by the Pillar 1 stress tests but also the capital requirements to cover the significant risks identified in the economic capital process.

In the US, Basel’s stress testing exercises are divided into two parts: stress testing pillar 1 and pillar 2. Each part deals with different stress testing tasks under the Basel concept of capital. To comply with BCBS’s Principles for Reliable Stress Testing, US regulators have jointly issued a stress testing oversight guide for banking institutions with aggregate consolidated assets of over S $ 10 billion, effective July 23, 2012.

Component 1 and Component 2: Stress Testing

- Component 1 stress testing aims to understand business cycles, especially downturns. Influence capital requirements based on risk assessment, including migration between ratings or segments, and the benefits of a dual default regime to mitigate credit risk, if appli

- Component 2 stress testing is included in the Internal Capital Adequacy Assessment Process (1CAAP), focusing on the firm’s overall capital needs and potential fluctuations. Pillar 2 stress testing addresses not only the changes in the minimum regulatory capital requirements identified by the Pillar 1 stress tests but also the capital requirements to cover significant risks identified in the Economic Capital Process (ECAP). The work done under Component 1 can be annexed or a starting point for any stress testing of Component 2.

As part of the Pillar 1 process, banks are expected to manage their regulatory capital so that it remains at least adequately capitalized throughout all stages of the business cycle. The bank is required to use a range of plausible but serious scenarios and methods, which may be historical, hypothetical, or model-based. The scope of Pillar 1 stress testing should be broad and include all material portfolios. However, a bank may choose to use stress scenarios that apply to the entire portfolio or specific scenarios applicable to different sub-portfolios.

Pillar 2 lacks prescriptive stress testing requirements. Banks, however, are required to use stress testing or similar exercises in the Internal Capital Adequacy Assessment Process (ICAAP) to identify and measure significant risks such as liquidity risk, reputational risk, and strategic risk in addition to the risks required by Component 1. , and considering the consequences of unlikely but serious events and results as inputs to the capital adequacy assessment process.

Stress testing should be applied at various levels of the banking organization and help plan capital and liquidity.

Building on previously issued supervisor guidance sets out the principles for a satisfactory stress testing framework followed by a banking organization. It describes stress testing as an integral component of risk management.

- Principle 1: The structure of the stress testing of a banking institution should include activities and exercises that are adapted and adequately reflect the banking institution’s activities and risks.

- Principle 2: A practical stress testing framework employs several conceptually sound stress testing activities and approaches.

- Principle 3. A useful stress testing framework is future-oriented and flexible.

- Principle 4: Stress test results should be clear, actionable, and well-reasoned, and should be used in decision-making.

- Principle 5: The organization’s stress testing structure should include sound governance and adequate internal controls.

Approaches and applications to stress testing include scenario analysis, sensitivity analysis, enterprise-wide stress testing, and reverse stress testing. Banking organizations should use several techniques and applications, depending on the purpose and scope of the test.

Given the importance of capital and liquidity to a banking organization’s viability, stress testing should be applied in particular in these two areas, including assessing the interaction between capital and liquidity and the possibility of simultaneous impairment of both.

Future improvements and best practices

The critical difference between sensitivity analysis and scenario analysis is that sensitivity analysis changes variables, parameters, or inputs without an exact root cause or description.

In recognition of the shortcomings of the stress testing systems used before and during the financial crisis, banks need to improve the granularity of risk presentation and the range of risks. Other areas where banks are considering improving in the future include:

- Continuous development and additional analysis of stress scenarios

- Researching new products to identify potential risks

- Improving the identification and aggregation of interrelated risks across ledgers, as well as the interaction between market, credit, and liquidity risk

- Assessment of relevant time horizons and feedback effects

With the development and popularization of stress testing, new types of it have appeared. These include scenario analysis, sensitivity analysis, enterprise-wide stress testing, and reverse stress testing. The choice of approach depends on the specific purpose and focus of the test.

Scenario analysis is a type of stress testing that evaluates the impact of historical or hypothetical scenarios. It can be applied at various banking organization levels and can be integrated into existing risk measurement tools of the bank, such as stress value at risk.

Sensitivity analysis refers to a banking institution’s assessment of its risks when certain variables, parameters, and inputs are “stressed” or “shocked.” The critical difference between sensitivity analysis and scenario analysis is that sensitivity analysis changes variables, parameters, or inputs without an exact root cause or description.

Enterprise Stress Testing is an application that includes assessing the impact of specific stress scenarios on the banking organization as a whole, especially concerning capital and liquidity.

Reverse stress testing is a tool that allows a banking organization to identify the types of events that could lead to an anticipated known adverse outcome. Reverse stress tests can identify previously unknown sources of risk that can be mitigated through improved risk management.

To conclude

In line with an international supervisory standard, US regulators are improving their stress testing tools and creating new tools to enhance the financial industry’s resilience. The US Agencies’ Stress Testing Supervisory Guidelines address the weaknesses identified in stress testing programs during the financial crisis. They are in line with BCBS’s international principles for reliable stress testing. CCAR and DFAST are derived from the Dodd-Frank Act, which became federal law in response to the financial crisis.

These two separate stress testing exercises aim to ensure financial health in the US financial sector through systems analysis and control.

Given the complexity of the various interrelated stress-testing rules, banking organizations must work closely with their key regulators and trusted third party providers to successfully implement a useful stress testing framework that helps them prepare for predictable and unanticipated capital and liquidity needs.

FAQ

A bank stress test is an analysis to determine whether a bank has enough capital to withstand an economic or financial crisis. Federal and international financial authorities require all banks of a specific size to conduct stress tests and report the results on a regular basis.

Dodd-Frank Act stress testing is a forward-looking exercise that assesses the impact on capital levels that would result from immediate financial shocks and nine quarters of adverse economic conditions.

Stress testing a Non-Functional testing technique that is performed as part of performance testing. During stress testing, the system is monitored after subjecting the system to overload to ensure that the system can sustain the stress.

One Response

The article provides a thorough overview of stress testing in banks, emphasizing its importance for financial stability. Informative and well-explained!