Table of Contents

In 2025, the fintech industry is expected to see continued growth and a surge in new solutions and innovations. Some of the top trends to watch for include digital payments, blockchain, artificial intelligence, and cryptocurrency. These developments are transforming the way we handle money, making financial services faster, more efficient, and more accessible. changing world of finance.

Fintech Industry Overview 2025

2022 has been challenging for all industries. However, it brought opportunities, especially for fintech companies. Despite turbulence and uncertainty in the global economy, financial service firms and banking need to adapt to challenges. Technology makes it possible by incorporating innovations into old-school legacy systems.

Growth of the Financial Technology and Fintech companies

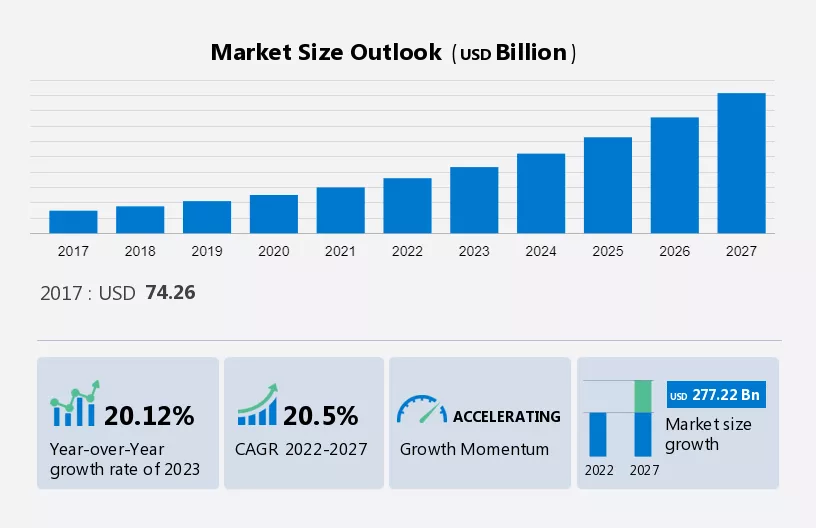

Fintech has experienced rapid growth in recent years, and this trend is expected to continue in 2025 and beyond. Technavio predicts that the worldwide fintech market will expand by USD 277.22 billion from 2022 to 2027 at a compounded annual growth rate (CAGR) of 20.5%.

So close integration between Finance and Technology and the constant need to adapt to a changing environment has driven a new wave of demand from businesses and customers.

Below are our CFO, Denis Korobeynikov, and CSC, Oleksandra Rostovtseva, thoughts on the Fintech ecosystem and ideas on where to invest money in 2025.

Insights into the Latest Fintech Trends

Fintech’s global market value is estimated to reach $305 billion by 2025. Based on current trends and market analysis, this prediction highlights the rapid growth and significant potential of the fintech industry.

Altamira has more than 10 years of expertise in digital product development and worked with leading startups around the globe as a fintech development provider. To deliver the highest result to our clients, we run monthly fintech landscape overviews to discover the hottest technology trends.

1. Increased Use of AI in Finance and Banking

Conversational banking & interaction with customers

Fraud detection

Risks management

Personal and commercial finance awareness is another direction where AI can be found useful and can save expenses on the number of banking operators who explain the financial sector to customers who need help understanding it.

2. How Regtech Revolutionizes Fintech Industry

What is Regtech?

Regtech is short for “regulatory technology.” It refers to the use of technology to help companies comply with regulatory requirements more efficiently and effectively.

Regtech revolutionizes fintech by providing innovative solutions for regulatory compliance. These solutions help financial institutions and fintech companies meet regulatory requirements while reducing the burden and cost of compliance.

Most banks still have massive compliance departments to manually verify financial transactions, keeping thousands of people and paying thousands of dollars to follow the regulations.

For instance, major payment processing platforms, like fintech company Wise, are adopting AI scripts to detect the “out of pattern” activity on customers’ accounts, sometimes even blocking accounts or suspending transactions for further human verification.

These scripts are based on the usual patterns for fraud transactions, such as a significant number of smaller transactions on one account or unordinary financial transactions (excessive amounts transferred, unordinary payment directions, and transaction behavior). And this is only the beginning of the tech journey in the RegTech sector, which often makes mistakes and makes customers unhappy.

Taking this to the next level with ML that can build the behavior prediction of the account holder and identify those out-of-pattern transactions (like supervising not only this specific digital transaction but the entire chain of multiple transactions that the human eye cannot analyze quickly) would lead to better customer satisfaction levels and easier fraud detection.

Fraud detection in banking with AI and Machine Learning

Implementing AI & ML for fraud detection screening, which could not only identify but also learn from the accuracy of such fraudulent transactions, will save costs and time for customers and personnel and make the banking system more secure.

E.g., usually, the bank would check the transactions of the people on sanction lists. But misspelling just one letter in the name can bypass the system and allow transactions.

There are many other ways to correctly identify and verify the sanctioned persons, like date of birth, address, history of personal data changes, analysis of chains of previous transactions, and whether this account has been involved in payments related to sanctioned persons. This means that dozens of massive databases should be assessed and analyzed in seconds, which human beings can’t do. So, AI-based algorithms could detect and prevent such occasions.

3. Robotic Process Automation in Banking

Robotic process automation or RPA is the automation of back-office tasks to save time on manual, repetitive, rule-based activities. For example, moving data, filling in forms, etc. These trends have touched all industries, but due to a large volume of paperwork in the financial and banking niche, RPA has taken a particular place in Fintech.

Due to the complexity of integrating innovative systems into legacy banking and finance solutions, RPA banking has become a life savior due to being isolated, independent, and easy to integrate.

What banks use RPA?

Deutsche Bank recently introduced RPA for its corporate clients in China, saving 60-80 hours of manpower monthly thanks to automation. By automating and streamlining complex processes, the RPA tool enables Deutsche Bank treasurer managers to get real-time data and actionable insights.

One of the largest Australian financial institutions, Heritage Bank has automated about 80 customer-facing, back-office, and middle-office processes. With the help of RPA developers, bank implements innovative financial products and AI bots to learn and build conventional business models.

RPA also becomes inclusive due to adopting open banking. Canada has announced that they are finally releasing the open banking system in Q1 2025, which should push for new opportunities in fintech.

4. How Open Banking is Changing Fintech

Open banking is disrupting the traditional financial landscape by giving consumers greater control over their financial data and enabling them to access new financial products and services that better meet their needs. It also helps banks to improve their customer experience, streamline operations, and reduce costs.

Ready to bring your banking app idea to life? Our complete guide will show you exactly how to create a secure and user-friendly app

What is open banking?

Open banking is a financial term used to describe a system where banks and other financial institutions make their customer’s financial data available to authorized third-party providers. This system allows customers to securely and easily share their financial data with approved third-party providers to access new financial services, such as budgeting management tools, personal finance apps, and comparison services.

Open banking is often facilitated by APIs (Application Programming Interfaces) that allow third-party providers to access customer financial data directly from banks and other financial institutions. This access to financial data is subject to strict security and privacy regulations to protect customer data.

5. Embedded Finance as a Fintech Innovation

What is embedded finance?

Embedded finance is an emerging concept that combines traditional financial services with digital products and platforms. It is a way of making financial services, such as payments and loans, available to users in a more streamlined and accessible way.

Embedded finance is also referred to as “fintech-in-a-box” because it is designed to be quickly and easily integrated into existing digital products, such as apps or websites.

Buy now, pay later, and Point-of-sale lending

The pandemic lockdowns showed that Buy now, pay later (BNPL) and Point-of-sale (PoS) lending could be helpful for people to access goods and services even when they don’t have all the money needed at that time. BNPL has increased in use on e-commerce platforms over the past five years, alongside with growth of unicorns in this direction, such as Klarna or Afterpay.

And according to the latest Bain Capital research, Buy now, pay later transactions will reach $265 billion by 2026, generating $4 billion in revenues for enablers.

The same is happening with PoS. The Mobile POS Payments segment worldwide is projected to grow by 13.92%.

PoS terminals have become available on consumers’ phones, avoiding waiters, shop personnel, distributors, etc. Having a mobile Point-of-Sale (PoS) system as part of an overall technology strategy is a great way to ensure that businesses are able to stay competitive in today’s fast-paced market. As the PoS market still doesn’t have defined leaders, every fintech product has a chance to win a race.

Want to tap into the booming 'buy now, pay later' trend? Contact us to learn more

Let us help you create a custom app that meets

the unique needs of your business and customers.

6. The rise of Alternative finance & Digital Lending

The rise of alternative finance models such as P2P lending, crowdfunding, and invoice trading has disrupted traditional banking and finance systems, offering more accessible and efficient options for individuals and businesses.

7. Traditional banks vs. Mobile Banking vs. Digital Banking

The demand for simplicity and the need for more patience with traditional banking gave rise to Neobanks, which are online banks with no physical departments or presence. Neobanks’ main user base is young people attracted by the modern, easy-to-use interfaces, gamification, no bank account fees, and simplicity of onboarding.

At the same time, electronic payment systems like Wise or Payoneer are getting closer to traditional banking by getting regulated. FCA had to explain the difference between a “bank” and an e-money institution to differentiate electronic payment systems from traditional banks.

In the future, the edge between electronic payment gateways, banks, and neo-banks will become thinner and thinner. While banks try to upgrade themselves with modern technologies to win over the young generation, modern payment systems have reached the point where governments will try to bring them closer to the regulated markets.8. Fintech Blockchain future

Despite the significant drop, blockchain still holds its crown in financing. Blockchain addresses the problem of unsecured and expensive fund transfer processes with the high speed of transactions and a significantly lower cost.

So in 2025, blockchain technology is expected to continue playing a significant role in the financial world.

10 Blockchain Startups Disrupting The Financial Services Industry

The decentralized and secure nature of blockchain is expected to be utilized in various fintech applications, such as:

Cross-border payment services: Blockchain can enable faster and more secure cross-border payments.

Digital assets: Blockchain can provide a secure and transparent way to store and trade digital assets, such as cryptocurrencies and digital collectibles.

Decentralized finance (DeFi): Blockchain can create decentralized financial services, such as lending, borrowing, and health insurance.

Identity management: Blockchain can create decentralized identity systems that offer increased privacy and security.

Supply chain management: Blockchain can provide a transparent and secure way to track the flow of goods and assets in supply chain networks.

Our unique MVP Service will help you to validate and structure your ideas, discover all the unknowns and mitigate development risks.

Sign up for Free Discovery Call

10. Unifying data and AI for fintech services

The growing waves of migration and immigration crisis bring the new challenge of personal financial profiles unification & standardization. Displaced people lose their credit history and economic incentives and generally need help changing the tax or residence-related financial aspects.

Unifying data in fintech involves combining multiple data sources, such as customer transactions, demographic information, and market data, into a single, integrated system.

This process can involve data integration, data warehousing, and data governance practices. The goal is to provide a comprehensive view of the customer, market, and operations, enabling financial institutions to make informed decisions, enhance customer experience, and drive efficiency of operational costs.

Unlock your project's potential.

Answer 10 questions and get a comprehensive project estimate

and take the first step towards success

Recap

The financial system is one of the first to react to the challenges like pandemics or war.

The “black swans” push financial systems to become more inclusive and simplified and make changes. And the easiest way to change is through adopting technology.

This is why the finance industry is still forecasted to grow despite the predicted business recession.

FAQ

Fintech solutions refer to financial technology solutions, which are innovative technology-driven solutions that aim to improve and automate traditional financial services. Fintech solutions are designed to provide more accessible, efficient, and convenient financial services to consumers and businesses.

Fintech is a term that describes technology to improve and automate financial services. It encompasses many products and services, including mobile banking, digital wallet, investment mobile apps, peer-to-peer lending platforms, and more. Fintech is transforming the financial industry by making it more convenient, accessible, and cost-effective for consumers.

The four main categories of fintech are: Payments and Money Transfer, Online Lending, Wealth Management, and Digital Insurance.

Some of the most widely adopted and successful fintech products include: payment gateway PayPal, Robinhood, Square and TransferWise.

FinTech software development involves developing financial technology solutions using software engineering and technology. It consists of creating innovative fintech startups that aim to automate, improve and modernize the traditional finance segment. This can include digital payments, online lending, robo-advisory, wealth management, insurance, and more.