Table of Contents

In the past decade and a half, financial technology, or Fintech, has become an integral component of our financial well being—indeed, of our daily lives. At the dawn of the 21st century, financial technology primarily focused on modernising banking systems through technological advancements. However, it has since matured into a distinct fintech industry with core functions and services deeply rooted in finance, transactions, and security.

Exploring the different types of Fintech

The concept of fintech refers to a broad array of segments within the financial technology sector. Its definition often differs markedly depending on whom you ask. This variability can make it tricky for newcomers to grasp the depth of what Fintech entails.

Nonetheless, there’s a general consensus that Fintech relates to any online application facilitating or leading to financial transactions. Key categories that fall under the expansive umbrella of Fintech include the following.

Digital Banks

Gone are the days when visiting a physical bank was required for routine or business banking transactions. Traditional banking is experiencing pressure as a growing number of digital banks, which operate exclusively online, offer customers the convenience of opening savings and checking accounts remotely. These online entities also assist their clients with deposits, withdrawals, and transfers, further transforming the banking sector.

Cryptocurrencies & Blockchain Technology

Blockchain technology holds the promise to transform numerous industries, yet its impact has been most notably felt within the fintech sector.

As the foundation for cryptocurrencies, blockchain employs encryption to control the creation of currency units and authenticate fund transfers. This digital currency framework employs the capacities of blockchain technology to ensure secure and transparent financial transactions.

Enterprise Tools & Software

In the domain of Fintech, two primary categories stand out:

- Software-as-a-Service (SaaS)

- Cloud-Based Point of Sale (POS)

Both operate in the cloud, offering the flexibility to be accessed from any location and at any moment. POS systems enable business owners to execute transactions effortlessly while on the move, as well as to oversee their store’s activities and metrics in real-time.

Insurance

Referred to as “insurtech”, this fintech branch is one of the latest additions to the industry. Moreover, insurtech is reshaping customer expectations and experiences. Its rise has been facilitated by several key technological advancements, including artificial intelligence, machine learning, big data analytics, and blockchain.

Traditional insurance models often involve complex paperwork and lengthy processing times. In contrast, insurtech platforms typically offer user-friendly interfaces, instant quotes, and rapid claims processing. This shift towards customer-centric services is attracting a younger, tech-savvy demographic that values convenience and speed.

RegTech

This segment of Fintech employs software and mobile apps to help individuals and businesses navigate market-specific and swiftly changing regulatory landscapes. This technology also supports enterprises in fighting financial crime and reducing risk through various means, such as cybersecurity, fraud detection, while streamlining the customer onboarding process.

Mobile Payments

Many of you might have used well-known apps like PayPal, Apple Pay, Google Pay, Venmo, or even Google Play to make or receive payments.

The global pandemic shifted global focus towards the potential for cashless transactions, diminishing the role of cash across all sectors to reimagine their payment methods.

The benefits of mobile payment options vary based on their specific features. Leading mobile payment platforms such as Google Pay and Venmo have attracted a large user base; for example, Venmo boasts over 65 million daily users, underscoring the app’s reliability in the eyes of its users.

Peer-to-peer lending and borrowing

FinTech has opened up promising avenues for overhauling traditional lending and borrowing frameworks with innovations such as Peer-to-Peer (P2P) lending platforms leading the charge.

These platforms offer users the convenience of accessing loans at any time, coupled with the flexibility to assess a borrower’s creditworthiness in new ways. Additionally, Fintech eliminates the necessity of visiting a physical bank or office to secure a loan, further simplifying the borrowing experience.

P2P lending platforms leverage the capabilities of Decentralised Finance (DeFi) to ensure easy access to financial services and enhance the user experience. Protocols like Compound and Aave are noteworthy examples within the DeFi-based lending sector.

Personal Finance Management

Personal finance management represents a critical and personalised facet of the fintech ecosystem, designed to improve wealth management and retail investment processes. Known as WealthTech, this specific fintech branch offers a value-driven approach to improving financial operations through increased efficiency and automation.

The main objective of WealthTech is to simplify the investment process, making it simpler and more transparent for investors to manage their portfolios.

Crowdfunding

The crowdfunding sector is poised for consistent expansion over the forecast period from 2021 to 2026, anticipating a compound annual growth rate (CAGR) exceeding 16%. Crowdfunding platforms have shaken up the traditional approach to securing loans or funding for projects by eliminating the need to approach banks or present pitches to venture capitalists.

In discussing the diverse categories of Fintech, it’s important to highlight how these innovations have introduced new avenues for raising capital. Crowdfunding fintech services present a prime opportunity for micro and small enterprises to connect with investors and secure funding for their initiatives.

Robot-based advice and stock trading

The significance of artificial intelligence and machine learning in the rapidly expanding fintech sector cannot be overstated. Robo-advisors are sophisticated fintech applications fuelled by AI and ML, designed to guide financial decisions.

This innovation offers financial service consumers an alternative to seeking out human experts for financial advice. What’s more important, a robo-advisor operates continuously, offering 24/7 data analysis without ever needing a break.

Having explored the diverse landscape of Fintech, it becomes clear that these innovations are not just reshaping finance — they are also inevitable tools for the growth and management of modern businesses. Let’s explore how these Fintech solutions are specifically influencing small and medium-sized enterprises.

How has Fintech impacted small and medium-sized businesses

Fintech has become an essential factor for anyone starting a business. In the past, from the era of cash transactions to the introduction of the first Electronic Funds Transfer at Point of Sale (EFTPOS) terminals, businesses faced limited options for payment acceptance. Today, a myriad of choices is available for payment processing, accompanied by a wide range of fintech solutions designed to support the growth of small businesses.

1. Accept payments easier

Beyond traditional cash, credit card payments, and debit cards, there are now contactless payments like Apple Pay and even cryptocurrency options. Moreover, payment methodologies are no longer confined to in-store transactions.

Amidst the surge of digital eCommerce, numerous companies are branching out with online storefronts. Even traditional brick-and-mortar establishments can leverage the advantages of Fintech, allowing customers to order and pay online for streamlined pickup or delivery services. This integration of fintech solutions into various business models underscores the impact of financial technology on commercial operations, enhancing efficiency and customer satisfaction.

2. Integrated financial management

Managing finances and maintaining accurate records can be daunting for many small and medium-sized business owners. Countless hours are often spent each week tracking bills, payments, and invoices. Fortunately, Fintech has introduced a range of integrated financial management systems designed to simplify these tasks significantly.

For example, revenue generated through your Point of Sale (POS) system can now be automatically logged into your accounting software. Bills and invoices can be digitised through scanning, eliminating the need for manual entry. Payments for bills can be automated, and customer direct debit arrangements can be easily set up.

These interconnected systems make financial management largely automated, streamlining operations and reducing manual labor. Moreover, business owners can effortlessly access detailed reports and gain insights into their cash flow and overall financial health with just a few clicks, improving decision-making and operational efficiency.

3. Making financial technology easy to adopt

Small and medium-sized businesses frequently face challenges in adopting new technologies due to the steep learning curves associated with complex systems like finance. It’s clear that, historically, these complex systems have posed difficulties for business owners.

Fintech, mirroring trends across various industries, prioritises the end-user experience. Consequently, modern financial technologies are crafted to ensure ease of adoption and user-friendliness. This focus extends to integration capabilities, highlighting how modern fintech solutions are designed to connect smoothly with third-party software.

4. Helping small businesses grow

Fintech opens up pathways for business expansion by offering products to minimise the time required for financial management. With quicker payments, largely automated record-keeping, and simple inventory synchronisation with online stores, business owners can allocate more time to strategic growth rather than administrative tasks.

Moreover, Fintech isn’t solely focused on the management of finances but also significantly enhances access to financial resources. Small businesses now enjoy unprecedented connectivity with lenders and investors, ready to support their growth ambitions and bring innovative ideas to fruition. This dual advantage of streamlined financial operations and easier access to capital positions FinTech as a major tool for business development.

Fintech categories with the greatest potential in 2024

Cross-Border Payments

Anticipate significant advancements in both cost-savings and accessibility, especially in countries that are proactive in adopting fintech innovations. This shift promises to streamline international transactions, making them faster and more affordable for users worldwide.

Personal Financial Management

The integration of technologies such as big data, artificial intelligence, and machine learning is set to reimagine the way customers manage their finances. Users can look forward to receiving tailored budgeting advice and financial management strategies. Platforms like Mint are leading examples of this trend, offering personalised financial insights and recommendations.

Digital Wealth Management

The FinTech sector is poised for a leap forward in using data for predictive analysis and advanced financial analytics. These advancements are expected to be instrumental in building stronger investment portfolios and providing sophisticated wealth management advice, catering to the needs of investors seeking to maximise their financial potential.

InsurTech

Bolstered by advancements in artificial intelligence technologies and machine learning algorithms, InsurTech companies are set to offer a more nuanced analysis of insurance applications. This evolution will facilitate the provision of insurance plans that are not only pertinent but also customised to fit the unique budgetary considerations, expectations, and needs of each client, marking a significant step towards personalised insurance services.

Asset Management

The adoption of blockchain technology is expected further to fuel the growth of securities and tokenised assets, positioning them as a rapidly expanding category within crypto asset management. This development will likely elevate the status of blockchain and tokenised assets to a prominent position among fintech innovations, showcasing their potential to streamline traditional asset management practices.

Our experience in the financial services industry

Our team has delivered a Ticker Tocker solution, an innovative trading platform powered with educational, broadcasting, and social networking features aimed at simplifying the trading process and enabling users to profit from trading and selling products.

Key features developed include:

- Highly detailed charting tools

- Personalised chart views

- Market trend analysis, and opportunity identification

The app fosters a community where traders can monetise innovative strategies, integrates a trusted broker base for smooth trading, and includes automated trading and backtesting functionalities. A subscription model allows users to follow top traders, mitigating the fear of loss and encouraging trading activity.

Financial information system Stockino is a “boxed solution” designed to meet the strict requirements of the Slovak and Czech National Banks while automating and digitising the internal processes of financial companies.

Stockino solution offers an open platform for stock traders, functioning in web browsers and available in both cloud and on-premise environments to meet various security requirements. It features encrypted personal data, secure SSL communication, and a closing system for efficient transaction data consolidation. It includes the following features:

- Modules for bank accounts, property accounts, investment strategies, contracts, transactions, instructions, shops, securities, etc.

- Modules for order placement, confirmation, and market entry, with split responsibilities between front-office and back-office roles.

- Complex reporting module for both legal requirements and internal needs, including Anti-Money Laundering reports.

- A plugin for tracking portfolio performance.

Stockino operates on a simple EULA licensing pricing policy, including an installation fee and a monthly license fee based on the modules used. A Service Level Agreement (SLA) is also required to meet regulatory standards.

This solution supports digital onboarding and provides a client zone for real-time access to financial or asset account balances, buy/sell instructions, and contractual documentation, delivered as a white-label solution customisable to the trader’s visual identity.

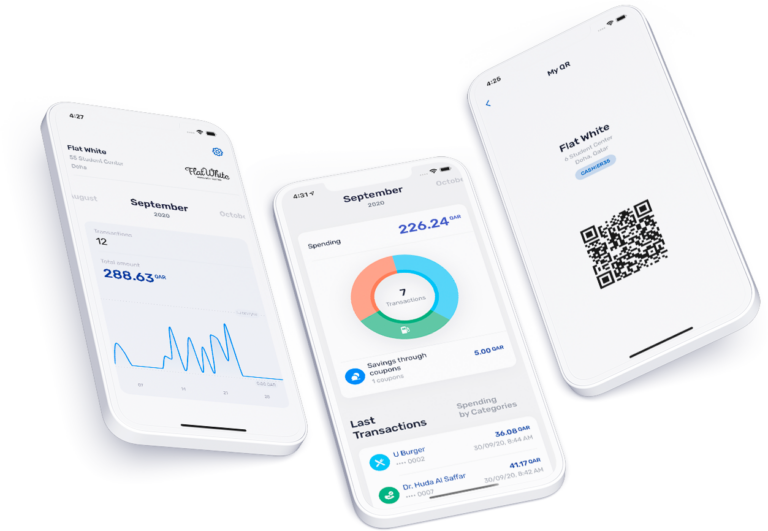

SkipCash is a mobile payment application designed to facilitate card payments without the need for physical POS terminals in Qatar, where such technology is not widely adopted. This solution serves sellers and buyers by enabling QR-code transactions, improving convenience and security for card payments in a region preparing for increased tourism and events like the FIFA World Cup.

SkipCash was developed using React Native for cross-platform compatibility on iOS and Android, emphasising user security and compliance with PCI DSS certification.

The app caters to both buyers, offering easy payment and discount opportunities, and sellers, providing an admin interface for management and financial reporting.

Technology has often been a barrier for businesses, as it has been too complicated or expensive to invest in. Altamira looks to break down those barriers and offer products everybody can use.

Bottom Line

As we move through 2024, choosing the right Fintech services is essential for any business looking to stay ahead. To make an informed decision, consider the following factors:

- The specific financial goals you aim to achieve

- The level of technological integration in your current operations

- The type of customer experience you wish to provide.

For those seeking streamlined transactions and global accessibility, digital banks and cross-border payment solutions may be the way forward. If personal or customer wealth management is a priority, then personal finance tools could be more beneficial in your case. Ultimately, the ‘right’ Fintech for you is one that aligns with your objectives, simplifies your financial operations, and improves your overall financial health.

Choosing us as a software development partner for your project, you'll get:

- Proven expertise in custom FinTech software development

- Expertise in GDPR, KYC, ePrivacy Directive, etc

- Experience in integration 3-rd party services, ranging from financial APIs to ApplePay

- Flexible cooperation models, including Outstaffing, Dedicated teams, Time and Material

Contact us to get expert consultancy on your financial products!